Bitcoin continued to struggle after Monday’s sell-off, although the cryptocurrency appears to be stabilizing at just above the $40,000 support level at press time. BTC is down 3% over the past 24 hours, and analysts expect the pullback to come close to an end later this week.

“Before the flash crash earlier this month, funding rates were pretty high, which tends to imply an influx of longs levering up,” Delphi Digital, a crypto research firm, wrote in a Tuesday report. “However, this time around, the market was not positioned as aggressively, leading to a slightly brighter outcome.”

The funding rate is the cost to fund long positions in the market for bitcoin perpetual swaps, a type of derivative in cryptocurrency markets similar to futures contracts in traditional markets.

For now, technical charts show strong overhead resistance at above $45,000, which could limit short-term buying. Volatility could remain elevated this week with the U.S. Federal Reserve policy meeting concluding on Wednesday and the quarter-end bitcoin options expiry on Friday.

Over the long term, however, bitcoin’s uptrend remains intact. “The long-term uptrend still has a hold on bitcoin, with our monthly indicators pointing higher, putting short-term volatility into a bullish context,” Katie Stockton, managing director of Fairlead Strategies, wrote in a Monday report.

Stockton added that a broader pause in assets deemed to be risky such as equities, commodities and cryptocurrencies has prohibited alternative coins from regaining leadership for now.

Latest Prices

-

Bitcoin (BTC), $42,109, -4.5%

-

Ether (ETH), $2,894, -6.3%

-

S&P 500: -0.1%

-

Gold: $1,774, +0.6%

-

10-year Treasury yield closed at 1.321%

Relative returns

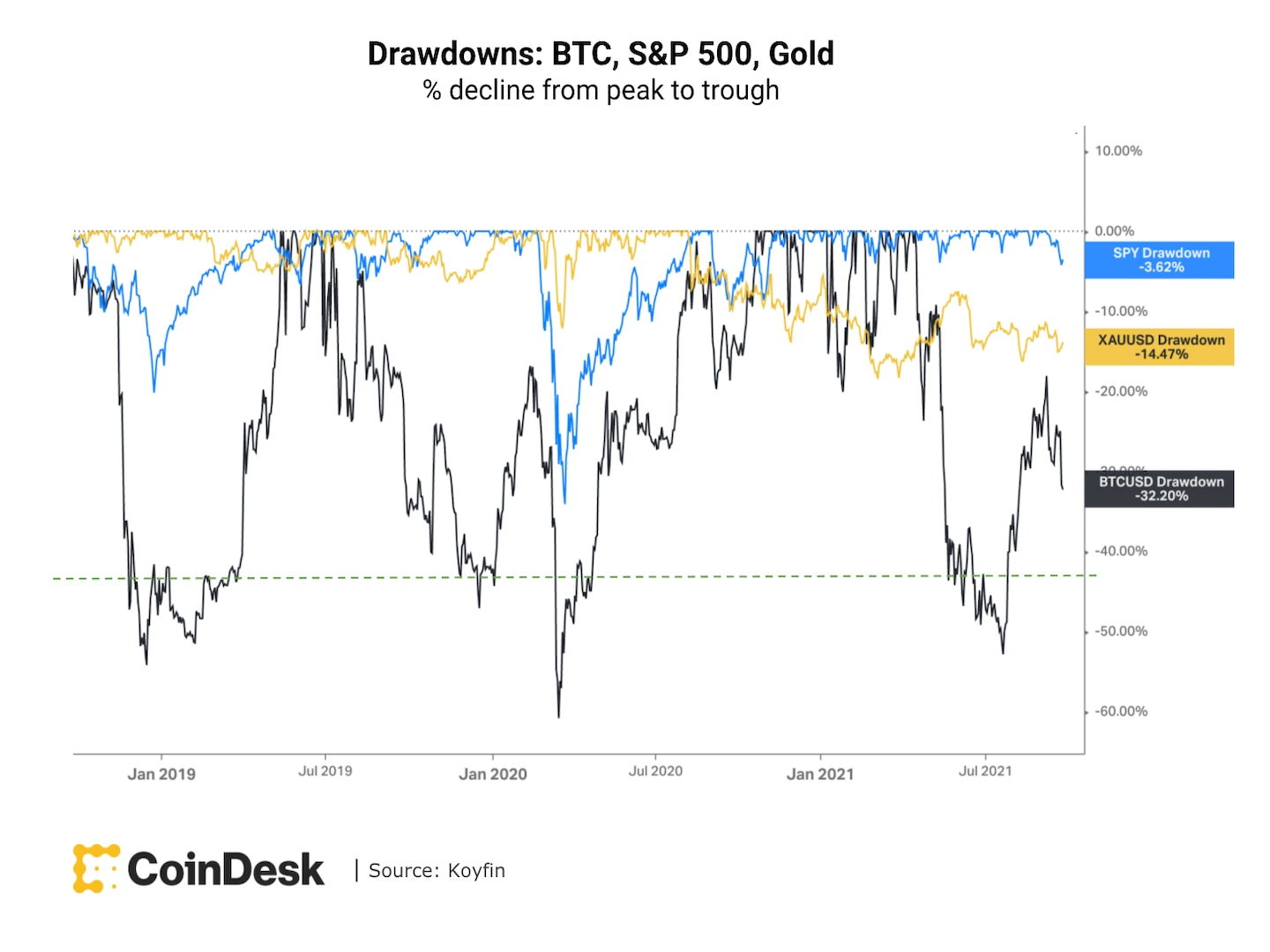

Despite the recent sell-off, bitcoin continues to outperform traditional assets such as equities and gold year to date. Still, BTC’s correlation with the S&P 500 has risen over the past few months, leaving the cryptocurrency vulnerable to general shifts in investors’ appetite for risk.

“Truth be told, the market rout we’re seeing is reflecting a wider set of risks than just Chinese property, and comes after increasing questions have been asked about whether current valuations could still be justified, with talk of a potential correction picking up,” Jim Reid, a strategist at Deutsche Bank, wrote in a Tuesday note.

Some 68% of investors surveyed by Deutsche Bank last week expect at least a 5% correction in equity markets before year end.

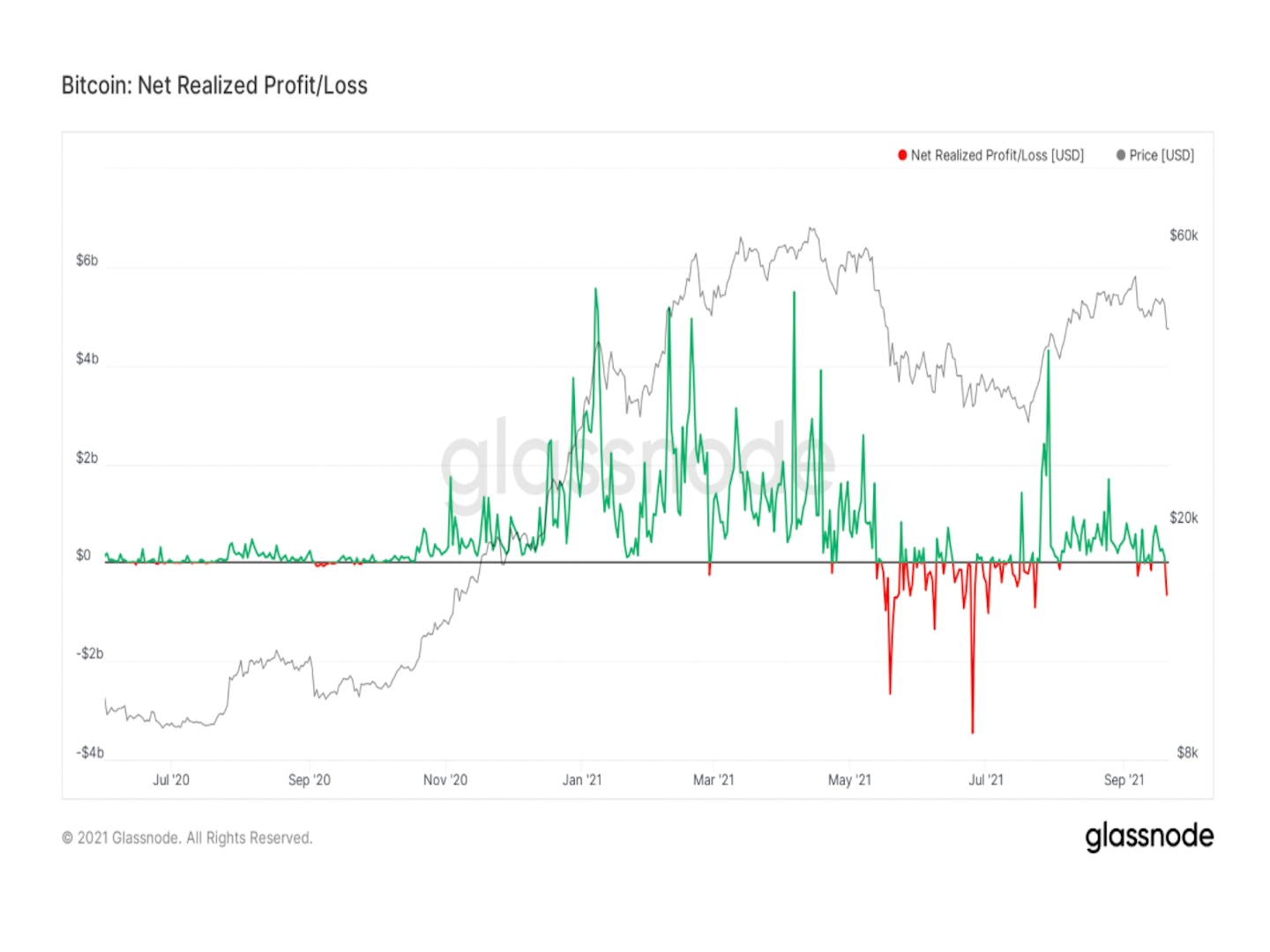

Realized losses deepen

As of Tuesday, the BTC realized net loss is at $650 million, according to blockchain data compiled by Glassnode. The chart below shows the bitcoin net realized profit/loss of all moved BTC over time. The current loss amount is the largest since June 25 when bitcoin was trading at about $31,600.

Further, futures data show BTC traders liquidated long positions at a greater pace than the sell-off earlier this month. That suggests that “many leveraged traders tried to catch the falling knife,” Glassnode tweeted, referring to traders who attempt to buy on the dip. It’s still too early to tell if more traders have liquidated short positions versus long positions, which could signal capitulation.

coindesk.com

coindesk.com