Popular on-chain analyst Will Clemente is looking at several key indicators that could point to a potential bear trap playing out in the short term.

After a recent rally to $42,500, Clemente expects Bitcoin to pull down slightly before “springing” back to make new highs.

“Still think we go down a little more for the spring through $42,000.”

Source: Will Clemente/Twitter

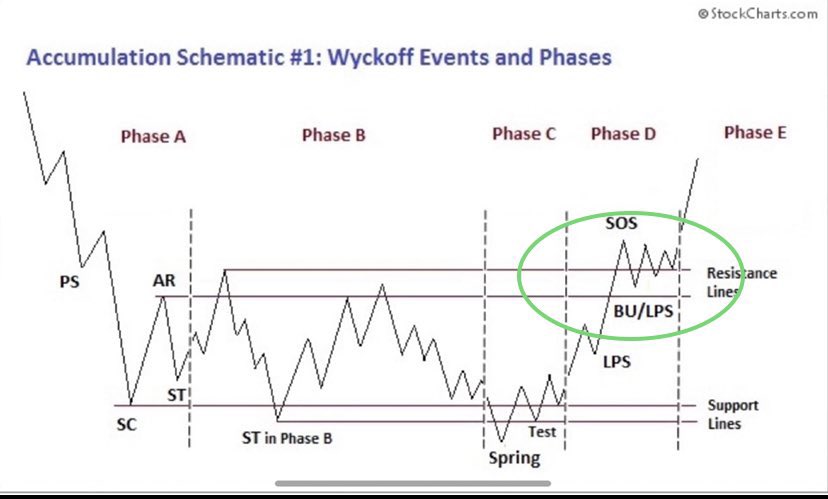

Clemente compares Bitcoin’s price action to a well-known trading schematic known as Wyckoff accumulation, a trading pattern where an asset trends in a range-bound construction allowing big players to accumulate.

“Vibes.”

Source: Will Clemente/Twitter

The blockchain analyst adds that on-chain volume at prices around $39,500 is reminiscent of on-chain volume when Bitcoin was priced at just $3,800.

This current price level has the most on-chain volume since $3.8K 👀 pic.twitter.com/6JmJDBdt5w

— Will Clemente (@WClementeIII) August 2, 2021

Lastly, Clemente points to the stock-to-flow (S2F) deflection model to show that Bitcoin looks primed for another rally after bouncing off its lower trendline. According to Glassnode, the S2F deflection model is used to determine whether an asset is overpriced or underpriced in relation to its scarcity. If the model goes below 1, it indicates the asset is undervalued.

“Historically speaking, following each touch of this lower S2F deflection trendline Bitcoin has gone on an absolute tear.”

Source: Glssnode/Will Clemente

dailyhodl.com

dailyhodl.com