Volatility is the defining feature of crypto investing. The past few months – with yet more whipsawed price action creating and then quickly destroying hundreds of billions of dollars in wealth – have provided a reminder of that. But despite these stomach-churning moves, money is flowing into crypto projects like never before. As we discuss below, perhaps it’s because this volatility problem has become a “known known” that investors simply factor into their valuation metrics.

One field of projects that has seen a boom is interoperability protocols, which tackle the big problem of getting different blockchains to talk to each other and enable cross-chain asset transfers without relying on a centralized intermediary.

In this week’s “Money Reimagined” podcast, Sheila Warren and I talk to two leaders in this space: Denelle Dixon, CEO of the Stellar Development Foundation, and Peng Zhong, CEO of Tendermint, who develops the Cosmos “blockchain of blockchains.”

Have a listen after reading the newsletter.

50% swings are mere flesh wounds

Spring is supposed to be a period of rebirth and growth. Not so in Cryptoland this year.

In a direct reversal of its spectacular gains through the winter, bitcoin dropped a painful 52% from its March 20 equinox peak to its summer solstice trough this past Monday.

You’re reading Money Reimagined, a weekly look at the technological, economic and social events and trends that are redefining our relationship with money and transforming the global financial system. Subscribe to get the full newsletter here.

Ether had a better first half of the spring, rallying from $1,800 on March 20 to an all-time high of $4,382 on May 11. But then it lost almost all of those gains in the following 40 days. Ether is currently trading at $1,854.

Meanwhile, during the same spring period, non-fungible token (NFT) auctions went from mind-blowing eight-figure digital art sales to a trickle of low-value deals.

What does this stark reversal of fortunes portend?

A consolidation to a lower base that will allow new buyers to come in and bid prices higher?

The start of another 2018-like quiet phase in which prices stagnate for a year or more while crypto developers continue to work on new projects?

Or something more ominous, such as legendary short-seller Michael Burry’s warning of the “mother of all crashes” that will see retail investors suffer losses “the size of countries?”

I don’t know the answer. If I did … well, you know how the line goes.

What I can say is we’ve been served another useful reminder that volatility is an ever-present feature of cryptocurrency markets.

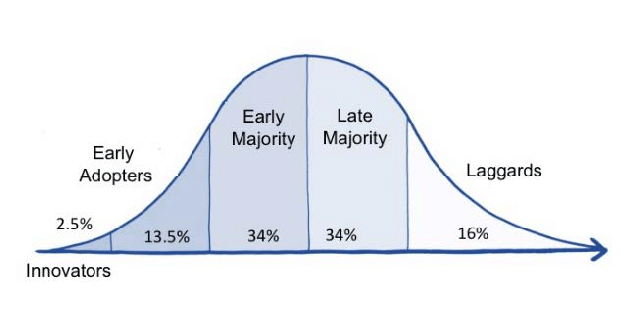

Volatility goes with the territory. The development of any highly disruptive technology, especially one that, much like the internet, aspires to achieve global adoption rather than just a niche role in the economy, will breed ups and downs in prices.

The good news is that even as prices get walloped, investors with multi-year time horizons seem to be getting more comfortable with this reality and continue to place long-term bets on the industry.

Crypto stability is impossible

I’ve always thought it unfair that economists dismiss bitcoin as too volatile to ever become a useful medium of exchange.

If that’s the case, there will never be an alternative to fiat currencies, as any new monetary technology would have to achieve mass adoption (and price stability) at the very instance of its introduction to society.

That third-highest peak you see on the right side of the chart is that surge in annualized ATM implied volatility to 150% seen in May. The latest activity shows a smaller spike to around 110% earlier this week, which seems to have quickly subsided back below 100% as the bitcoin price recovered Wednesday and Thursday.

So, although we’re still above the 75% average, this suggests that expectations for big price swings haven’t been as drastically affected by the latest price declines as they were in May. It also suggests that options traders who sold those puts back then, while no doubt unhappy the spot price fell as low as it did, aren’t suffering extreme losses.

The conversation: Black Swan wars

The bitter falling out between influential theorist Nassim Taleb, he of “The Black Swan” fame, and his former colleague Saifedean Ammous, for whom Taleb wrote a foreword to the first edition of Ammous’s “Bitcoin Standard” during a happier time in their relationship, just got worse. That’s because Taleb this week landed a six-page paper in which he explained in highly critical terms why he had gone back on his earlier enthusiasm for bitcoin and now, essentially, considers it useless. Ammous’s response to the paper said it all.

Taleb’s attack, in which he essentially argued that bitcoin should be currently priced at zero because of a supposed expectation that at some point in the future there will be no miners mining it, stirred rebuttals from many bitcoiners. Here’s an interesting rhetorical takedown of Taleb’s logic by University of Wyoming philosophy professor Bradley Rettler:

But perhaps more intriguing than the predictable backlash from bitcoiners was this critique (and the responses it elicited) from someone with a truly balanced – in parts quite critical – view of bitcoin: Cato Institute monetary historian George Selgin.

It’s clear, though, that some people were swayed by Taleb’s argument, and they, too, tended to come from the anti-bitcoin category. Here’s Joe Kelly, whose profile describes him as a “Bitcoin heretic.”

Relevant reads: Venture investors

As we mentioned up top, there’s been an inordinate amount of long-term investment in crypto from big-name players of late, both in venture deals and in in-house development. It stands in striking contrast to the doldrums in the crypto market. The stories highlighted from CoinDesk here are merely from Thursday, but these kinds of announcements have been coming for weeks.

- So, earlier in the day, venture capital giant Andreessen Horowitz, also known as a16z, announced it had raised $2.2 billion for its third crypto fund. As Zack Seward reports, the news suggests this is a good time to be raising crypto funds.

- Shortly after the a16z news, Tanzeel Akhtar reported that Citigroup’s wealth management division had launched a “digital assets group” to service clients “interested in all aspects of the digital asset space” such as cryptocurrencies, non-fungible tokens (NFT), stablecoins and central bank digital currencies.

- Meanwhile, blockchain forensics firm Chainalysis announced that it had closed yet another $100 million round of financing, this one putting the firm at a valuation of $4.2 billion. As Zack Seward reported, this follows a separate $100 million Series D financing round in May and brings the firm’s total fundraising tally to $365 million.

coindesk.com

coindesk.com