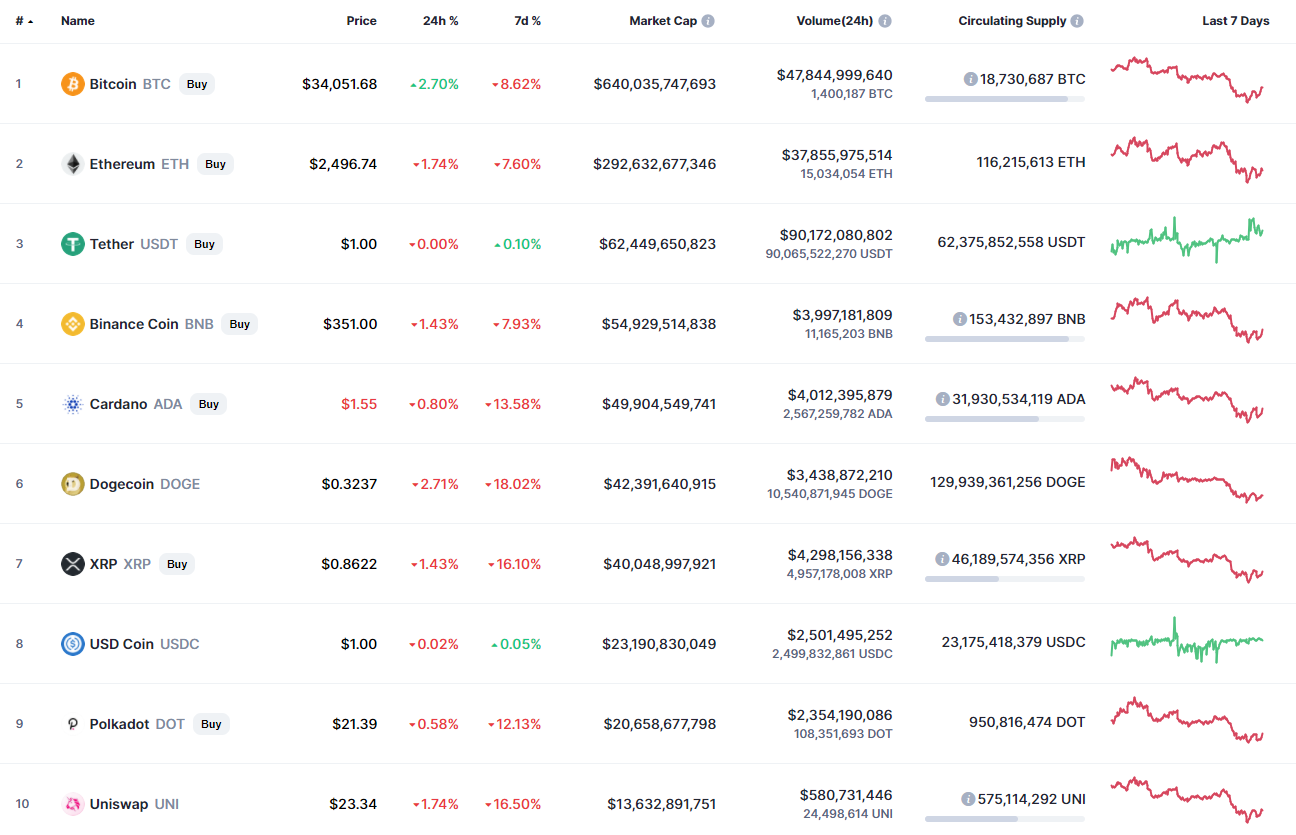

The cryptocurrency market keeps facing a bearish influence as the majority of the top 10 coins are in the red zone.

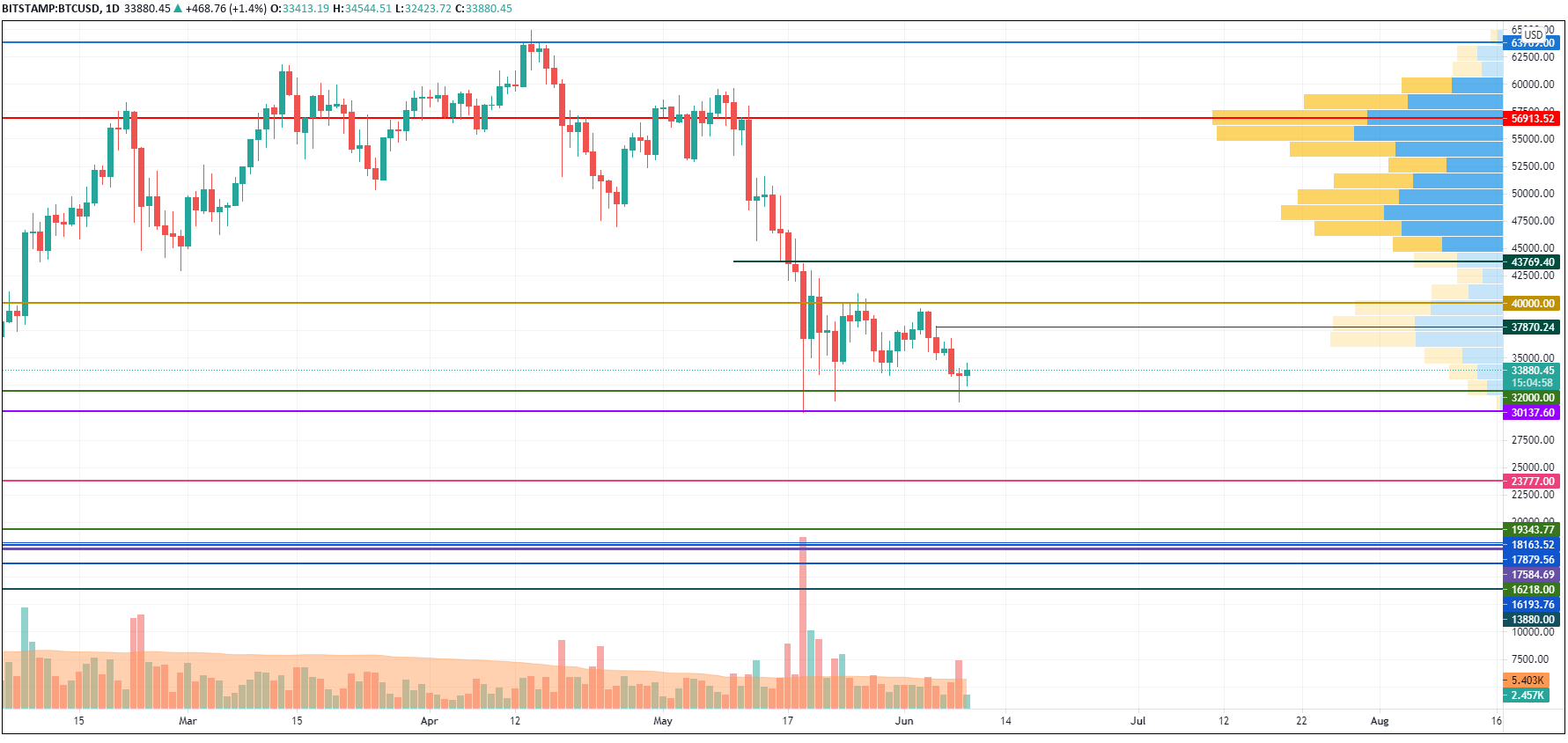

BTC/USD

Bitcoin (BTC) keeps growing while most of the other altcoins are going down. The rate of the chief crypto has increased by 4% since yesterday.

Bitcoin (BTC) has successfully bounced back to the support at $31,000, having confirmed the bulls' power.

From the technical point of view, one might expect short-term growth to the zone of the most liquidity around $36,000 within the next few days.

Bitcoin is trading at $34,074 at press time.

XRP/USD

The rate of XRP is almost unchanged since yesterday. The price has risen by 0.46%.

XRP is almost following the price action of Bitcoin (BTC). After a false breakout of the EMA, the price is coming back, which confirms the power of buyers. In this case, there is a high chance of seeing a test of the level of $0.94 soon.

XRP is trading at $0.8635 at press time.

BNB/USD

Binance Coin (BNB) has gained more, with growth making up almost 2% over the last day.

The native exchange coin has bounced off the support at $352. At the moment a bullish scenario is more likely than a bearish one as buyers have fixed above the support. Thus, the selling trading volume has decreased, which means that sellers have lost the initiative for a while. All in all, there are high chances of seeing a correction to the area around $380.

BNB is trading at $352 at press time.

LTC/USD

The rate of Litecoin (LTC) is also almost unchanged since yesterday.

The "digital silver" is also more controlled by buyers than sellers as the rate has fixed above the $150 mark. From the technical point of view, the ongoing bounceback might continue to the level around $200 where most of the liquidity is focused.

Litecoin is trading at $159 at press time.

u.today

u.today