As a sub-industry of crypto, decentralized finance (DeFi) has undeniably become a productive economy, generating billions of dollars in fees and distributing vast wealth to project founders and users.

In that arises the chicken or the egg question. Are users using these applications out of genuine want/need or are token incentives and yield artificially boosting demand?

There’s probably no clear answer to this because the outsized yield and real adoption are likely a positive feedback loop. This loop, in turn, bolstered the current market where users can earn yield on both sides of lending platforms or earn 50% annual interest in trading fees and token incentives for supplying stablecoin liquidity to exchanges.

There would likely be consensus within the DeFi community that these conditions are not sustainable and will come and go with speculation. Notably, yields dropped harshly in the early summer as asset prices fell and trading volume slowed. How much worse could it be in a sustained bear market like the one we experienced in 2018-2020?

Compound, a DeFi lending market, recently released a Q3 report, a first within the industry. The report highlighted that when token incentives were factored in, protocol earnings were negative. Compound has essentially been trading equity to rent liquidity that may or may not be sticky when it eventually decides to stop emitting COMP in coming years, as per the Compound governance model.

This is true for essentially the whole industry, outside of OpenSea, Maker, Uniswap and maybe a handful of others. For example, according to Banteg’s Dune dashboard, Curve emitted 33.3 million CRV to liquidity providers over the past 30 days worth $156 million. During the same period, Curve had $5.7 million in earnings for its protocol and token holders.

Read more: How Yield Farming on Curve Is Quietly Conquering DeFi

At face value, this would appear to be unsustainable, but Curve has created such important usage for its token that emissions do not equate to selling pressure. In fact, CRV’s inflationary mechanics have arguably brought in over $20 billion in liquidity to the exchange and been the largest reason for high trading volume and decent revenue accrual.

For every Curve there are easily 100 protocols that use inflationary tokenomics for short-term speculation and attention. Inflation and yield without adoption are a recipe for disaster, but a handful of successful early-stage protocols are eager to showcase how they can thrive in the long term.

Will a bear market show us whether these governance tokens are a way to bootstrap an ecosystem or if they are a complex way to dump on speculators?

Welcome to another edition of Valid Points.

Pulse check

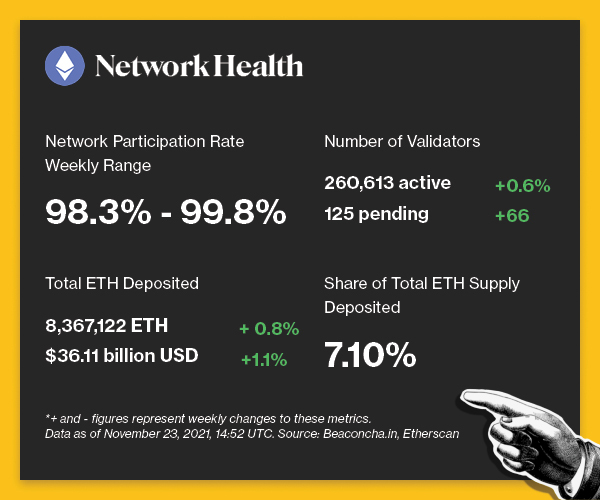

The following is an overview of network activity on the Ethereum 2.0 Beacon Chain over the past week. For more information about the metrics featured in this section, check out our 101 explainer on Eth 2.0 metrics.

Disclaimer: All profits made from CoinDesk’s Eth 2.0 staking venture will be donated to a charity of the company’s choosing once transfers are enabled on the network.

Validated takes

-

ConstitutionDAO was outbid on a copy of the Constitution by Citadel CEO Ken Griffin. BACKGROUND: ConstitutionDAO was one of the first examples of a decentralized autonomous organization (DAO) intersecting with the real world, highlighting both the potential and limitations of group work and collective thinking. The DAO crowdsourced over $40 million in capital in under a week.

-

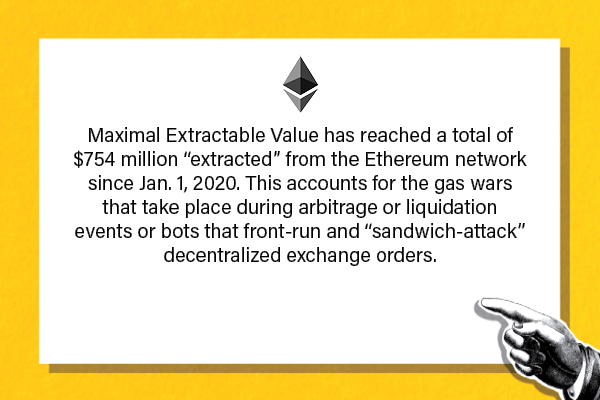

Ethereum Research is planning how to best mitigate the downsides of Maximal Extractable Value (MEV) on the proof-of-stake network. BACKGROUND: Flashbots has suggested creating a third-party block constructor that will closely resemble the current Flashbots marketplace. The mechanism will allow solo stakers to participate in maximizing block value and in theory distribute the roll of MEV on the network.

-

Binance plans to open withdrawal to Arbitrum, becoming a ramp to Ethereum’s layer 2. BACKGROUND: Binance, arguably the largest crypto exchange and backer of Binance Smart Chain, will be one of the first exchanges to offer deposits and withdrawals to an Ethereum roll-up. Bypassing Ethereum’s high transaction fees, the move will bring greater accessibility to DeFi, non-fungible tokens (NFT) and other on-chain activity.

-

Consistently high activity on Ethereum keeps ether in the deflationary zone. BACKGROUND: Base fees on the network have consistently outweighed block rewards, burning more ether than is emitted each day. If demand remains similar to current levels, the native asset will become much more scarce after the merge to proof-of-stake, where validation emissions are much lower.

Factoid of the week

coindesk.com

coindesk.com