- The price went down to $2.758 level.

- Fantom price analysis confirms bearish lead.

- Support is sufficiently strong at $1.80.

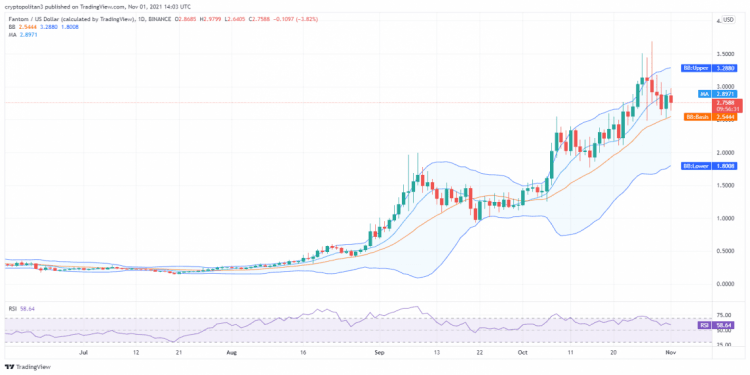

The price is headed down once again as the bears have been ruling the price charts since the past week. The drop in price has been quite considerable and the bearish trend has been continuously intensifying. The cryptocurrency faced a decline in the last 24-hours as well, which is why the price has moved down to $2.76. Further downflow is to be expected as the price dropped down in the last four hours as well.

FTM/USD 1-day price chart: Bears retain their supremacy over the market trends

The one-day Fantom price analysis is indicating a downtrend for this week, as the price has been continuously falling. This has brought great damage to the overall cryptocurrency value as the price remained unable to cross its proposed target. The reversal in trends has set down the price to the $2.758 mark, which is quite disappointing for the buyers. The price is now standing lower than the moving average (MA) value i.e. $2.89.

The volatility has slightly decreased during the day, bringing the Bollinger bands average to the $2.54 level. Furthermore, the upper value of the Bollinger bands value is at the $3.28 mark whereas its lower value is at the $1.80 mark. The Relative Strength Index (RSI) has decreased up to 58.64 because of the selling pressure from the market.

Fantom price analysis: Price lowers to $2.76 as cryptocurrency follows decreasing trend

The four hours Fantom price analysis is displaying quite negative results for the buyers as the price underwent a significant decline in the past few hours. The bearish rally has resulted in the price going below the $2.76 level. Although considerable signs of recovery from the bullish side were observed earlier, the last few hours again proved favorable for the bears. The moving average is still below the current price and is resting at $2.76.

The SMA 50 curve is still traveling above the SMA 20 curve which is a further confirmation of the bearish lead. The Bollinger bands indicator is dictating a shift in values as well as now the upper value is at $3.02 and the lower value is at $2.582. The RSI score is showing a neutral figure of 46.41.

The general overview of the price movements is relating positive results as the price has reached many high points in the last few months. The technical indicators chart is indicating a bullish trend for the day. There are 13 indicators present on the buying position, nine indicators are there on the neutral position while four indicators are there on the selling position.

The moving averages is confirming the strong rise in price as well with a buying signal. We can see 12 indicators standing on the buying position, two indicators on the selling position while only one indicator is there on the neutral position. The Oscillators, on the opposite, are indicating a neutral trend for the day. There are eight indicators on a neutral level, one indicator on buying level, and two indicators on selling level.

Fantom price analysis conclusion

A considerable decline in price has been observed for FTM/USD in the last 24 hours. This has been further confirmed by both the one-day and four hours Fantom price analysis. A downtrend is seen dominating the market in the daily and hourly predictions, and the price has been reduced to $2.76. Further decline in price is to be expected as the bears are seen ruling the four hours price chart as well.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

cryptopolitan.com

cryptopolitan.com