In the cryptocurrency space, Ethereum is the leader in terms of earning revenue which remains the case even during the ongoing low activity times.

With just under $160 million in revenue, the second-largest network is bringing in some big numbers, followed by Uniswap at $104 million and PancakeSwap’s $45.21 million in the past 30 days.

The Bitcoin network has only earned $43 million in revenue and Binance Smart Chain $39 million.

While Ethereum is a clear winner, this revenue on the blockchain decreased by 14.50% in the last 7-days and 84.34% in the last 30 days.

This downtrend is pretty much the story of all the crypto market as volume has died down after the prices cashed 50% to 75% during the recent sell-off. While institutions are on the sideline, retail has taken a break as the market goes sideways.

Still, a handful of projects are still able to record growth during these times. Axie Infinity is one of them whose token AXS also surged 300% in the past week.

The project continues to grow, seeing $14.27 million in volume, an increase of 41% in 7-days and 285.85% in 30 days, as per TokenTerminal.

It is also leading the non-fungible token (NFT) space, with more than 15,000 traders bringing in $13.71 million in volume. Axie Infinity’s sales, volume, and traders, every metric is recording a surge, as per Dapp Radar.

Ethereum side-chain protocol Polygon is another one with over 18% and 305.95% increase in the past week and month. While generating $359.33k in revenue, which is growing since May and gaining momentum in June, Polygon also has just over $8 billion in TVL.

Meanwhile, in the past week, Synthetix also recorded a 24% increase in its revenue, with Nexus Mutual being the other one.

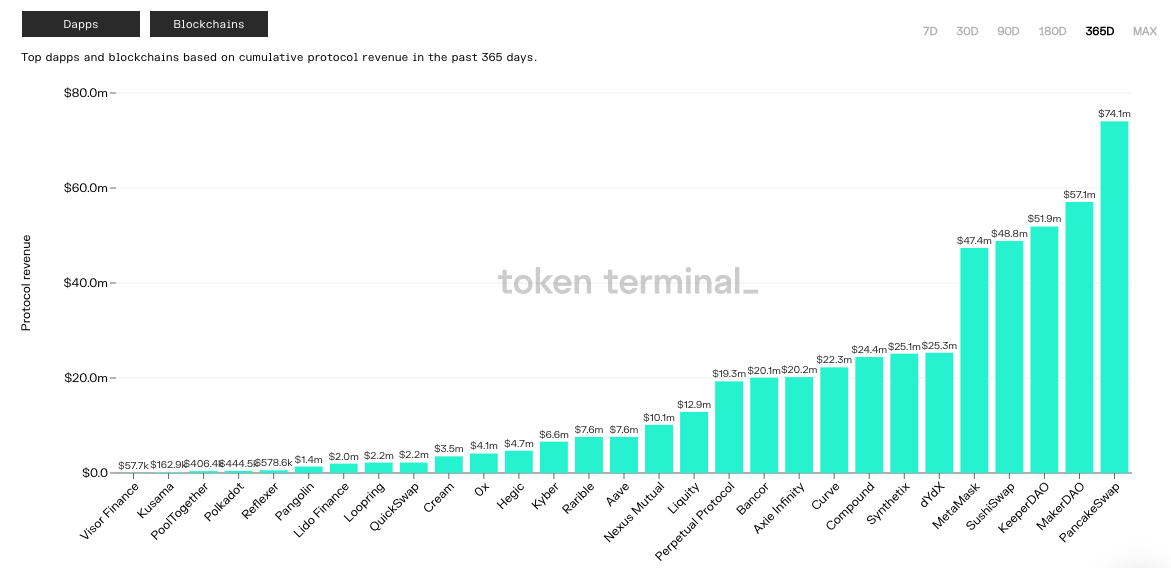

When it comes to lending protocols, the original decentralized protocol MakerDAO leads the DeFi sector in terms of revenue. Based on cumulative protocol revenue in the past 365 days, it overall ranks as the second biggest protocol after BSC-based PancakeSwap at $57.1 million. Meanwhile, its competitors Compound and Aave had $24.4 million and $7.6 million, respectively.

However, Aave is leading in terms of monthly users with its market share in June at 57.5%, while Compound has 23.9% and Maker 18.6%. Aave has really grown in popularity as a year back, while Aave had 10.4%, COMP’s market share was 42.7%, and Maker 46.9%.

While Compound still leads when it comes to the total outstanding amount, Aave has been gaining strength at over $3 million and under $1 million, respectively, while the total borrow amount on Maker is more than a million dollars.

Overall in the DeFi sector, the same as the entire crypto market, the number of users has fallen to September levels, with only a few thousand new accounts being opened daily, which was as much as 40k in mid-May. Nic Carter, the founding partner at Castle Island Venture, said in an interview,

However, Aave is leading in terms of monthly users with its market share in June at 57.5%, while Compound has 23.9% and Maker 18.6%. Aave has really grown in popularity as a year back, while Aave had 10.4%, COMP’s market share was 42.7%, and Maker 46.9%.

While Compound still leads when it comes to the total outstanding amount, Aave has been gaining strength at over $3 million and under $1 million, respectively, while the total borrow amount on Maker is more than a million dollars.

Overall in the DeFi sector, the same as the entire crypto market, the number of users has fallen to September levels, with only a few thousand new accounts being opened daily, which was as much as 40k in mid-May. Nic Carter, the founding partner at Castle Island Venture, said in an interview,

“DeFi is going to be challenged because it relies on this injection of new liquidity, and ultimately a lot of DeFi yields are a function of new buyers supporting token prices,” “I don’t think DeFi is going away, it just might be a less attractive place to park capital in the next few months.”

bitcoinexchangeguide.com

bitcoinexchangeguide.com