Crypto investment firm Pantera Capital thinks that panic in the crypto markets following the marketwide collapse in May is waning off.

Dan Morehead, chief executive of the firm, says that the markets saw a downtick primarily due to a combination of three events: news about China’s reported crackdown on digital assets, Elon Musk’s heel turn on Bitcoin, and Tax Day in the US, which the government delayed until May this year in response to Covid-19 pandemic.

The Tax Day downtick has happened in previous cycles, the CEO explains in a new blog post.

“Previous Tax Day cycles have hit local lows seven days before Tax Day. That makes tremendous sense. That’s about how long it takes to get your money out of an exchange and to your bank. The Bitcoin market hit a local low near $30,000 two days after Tax Day (the U.S. government pushed Tax Day to May this year). Only nine days off the historical average and within the period that makes intuitive sense.”

Morehead thinks current metrics indicate the markets have “seen the most of this panic” and won’t go lower.

Explains the chief executive,

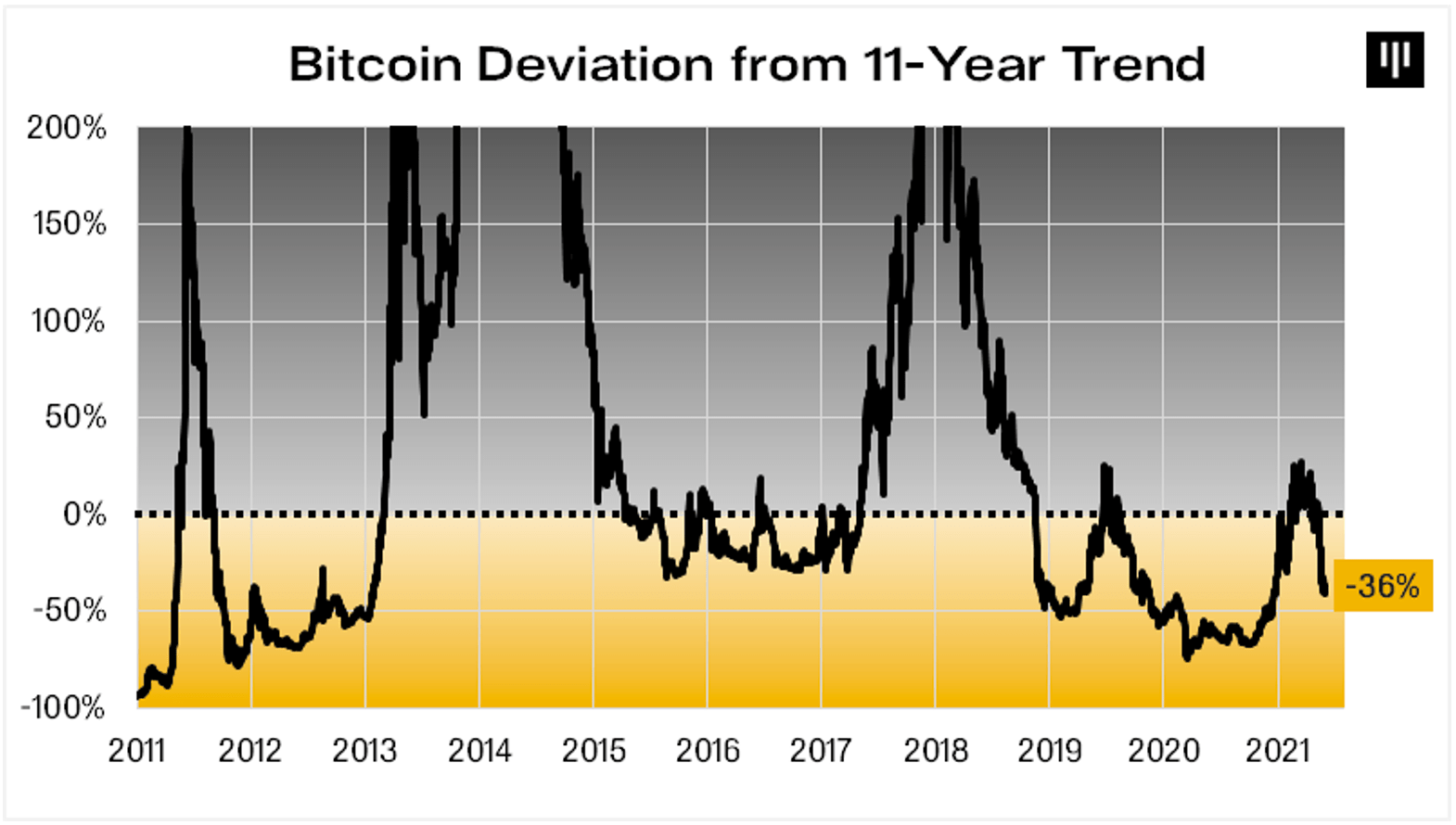

“Bitcoin is currently trading 36% below its 11-year exponential trend. Bitcoin has only spent 20.30% of its history as far under trend valuation.

At the recent peak, it went just a touch over trend value. As you can see, past peaks were many multiples of trend value.”

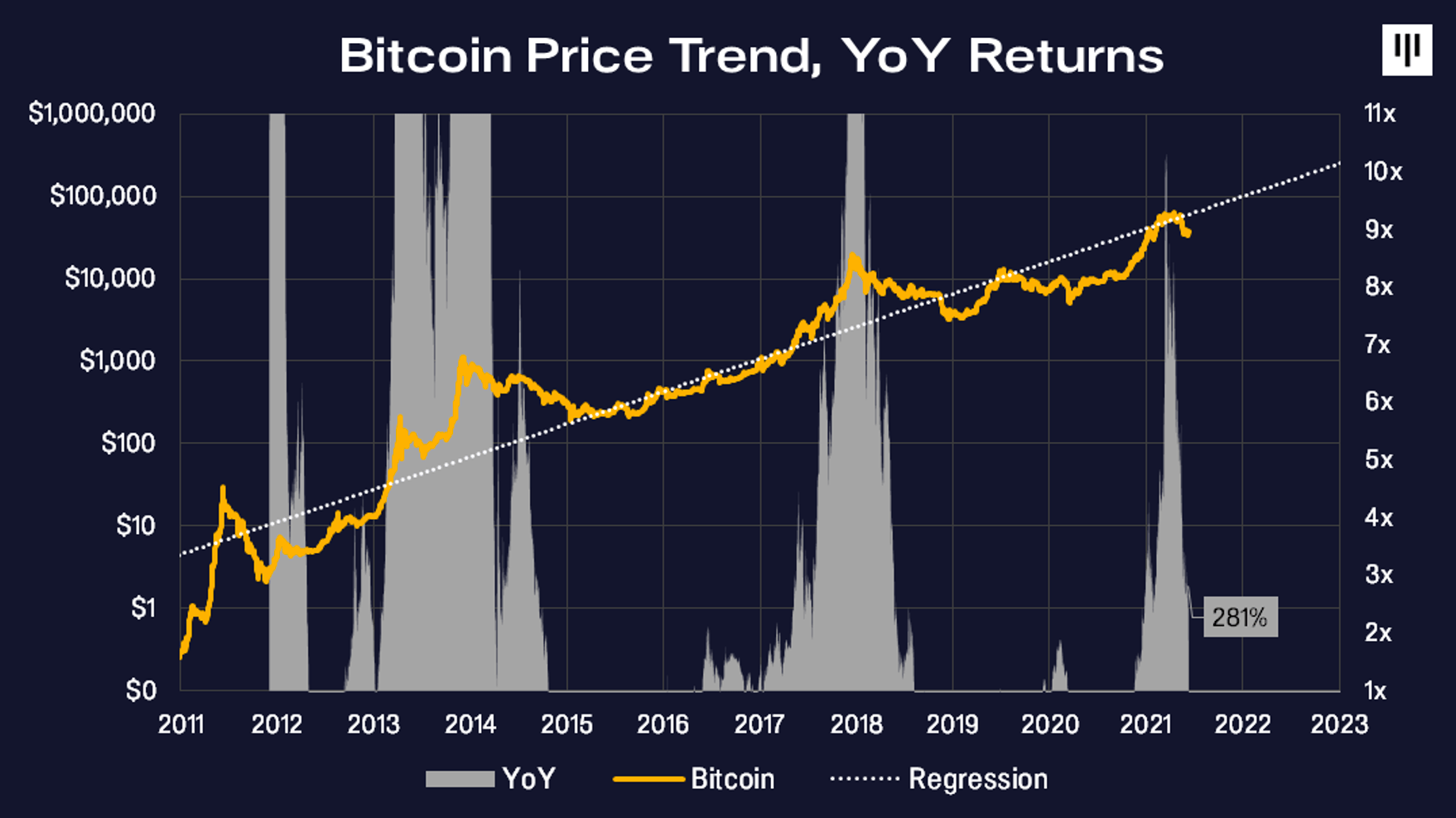

Morehead also thinks the year-on-year returns don’t indicate Bitcoin is overvalued either.

“The year-on-year return never went literally off-the-chart like in past peaks. It’s currently trading at 281% year-on-year – which seems entirely plausible given the money printing that has occurred in that period.”

dailyhodl.com

dailyhodl.com