Decentralization, scaling, and speed are the three challenges that Algorand ALGO/USD has attempted to solve since its launch in 2019. It does this by providing both the infrastructure, as well as the tools which many dApp developers require in order to create their apps and assets which can potentially be used by billions of people.

This blockchain, through implementing Pure Proof of Stake (PPoS), is capable of supporting 1,000 transactions per second (TPS) which does include smart contract transactions.

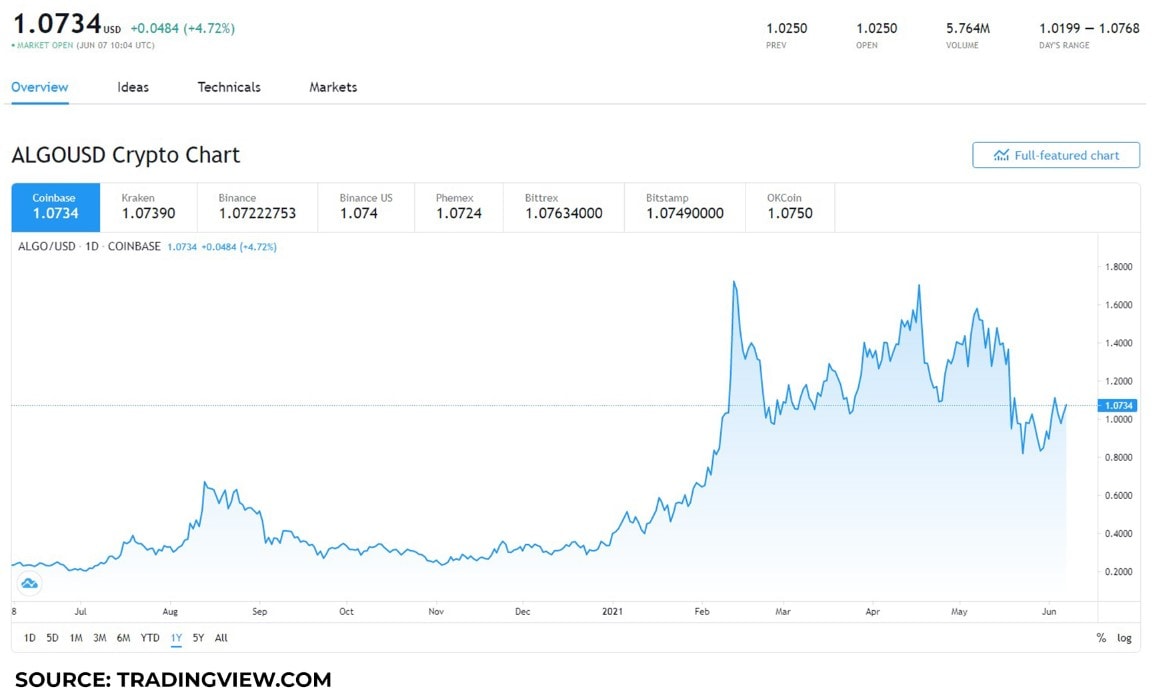

Is this alone a catalyst to buy ALGO now when it is trading at around $1.07? Let’s take a look and see what could be next for Algorand.

Should you buy ALGO?

On May 21, one of the first dynamic suits of non-custodial smart contracts on Algorand known as Yieldly launched staking contracts alongside a no-loss lottery their initial use-case. They are also continuing to grow their DeFi platform’s cross-chain capabilities. Yieldly aimed to be the first automated market maker for Algorand.

On June 2, Borderless Capital announced the launch of a $25 million fund in order to fund blockchain investment in Miami through the usage of Algorand alongside the stablecoin operator Circle.

However, that is not the only thing that happened. You see, on June 3, MAPay announced the implementation of blockchain-based solutions on Algorand to Reduce Healthcare costs in Bermuda.

When you combine all of this, you can have a clearer image as to where this project is going and what kind of appeal it might have to potential investors going forward. This has the potential of driving the price of ALGO up as a result, as more and more companies are announcing their investments through the usage of Algorand.

Mass adoption

Currently, there are more than 500 companies leveraging Algorand’s technology. The beauty behind the project is the fact that it enables the simple creation of financial products, protocols as well as the exchange of value across DeFi.

When we take all of the projects into consideration, we can see a pattern where, every time a new project launches or it gets mainstream media attention, the price tends to go above $1, but otherwise tends to stay below that mark. If you can buy ALGO at $0.80 or lower, it might be a worthwhile investment.

At $1 or above it can be difficult to recommend. Perhaps we can consider the $1 level to be a resistance point and we would need to see Algorand break above $1.60 before momentum investors jump in and the coin tests the $2 level.

invezz.com

invezz.com