Analysts warn investors about the dangers of placing their money on SafeMoon. The creators of the altcoin bill the cryptocurrency as a decentralized finance token that will skyrocket in price.

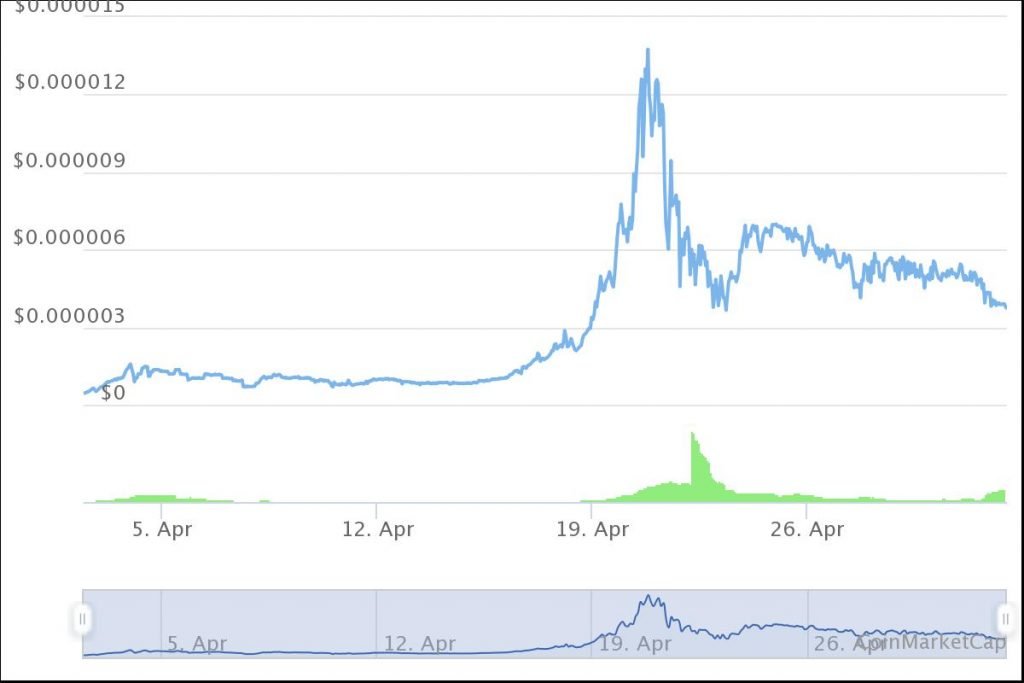

SafeMoon has rallied by 1,320% since its launch in March. It is also gaining much buzz, thanks to celebrities like YouTuber Jake Paul and rapper Lil Yachty who cheer for the token in their social media accounts.

Analysts, however, think that SafeMoon could be a pump and dump scheme that can hurt late investors.

“Gains are being fueled by frenzied chat across social media with influencers jostling for position to push their favored coins,” says Susannah Streeter, market analyst at investment company Hargreaves Lansdown. “Its model appears to be geared towards helping early holders of the currency get rich, as others pile in after them, pushing the price up further.”

SafeMoon is gaining attention from investors following the surge of the meme cryptocurrency Dogecoin that created overnight millionaires.

“It seems unlikely SafeMoon will ever make it to the moon”

Edward Moya, the senior market analyst at currency platform Oanda, told Business Insider Dogecoin largely influenced interest in SafeMoon, but he has a warning against the new token.

“Many view it as a pump-and-dump coin. Safemoon’s initial buzz started off as many anticipated it will have a similar rise like Dogecoin. It seems unlikely SafeMoon will ever make it to the moon.”

Regulators have long warned about investing in cryptocurrencies because of the volatile nature of this new asset class. Still, analysts say that investors should be more cautious about betting on some cryptocurrencies.

Bitcoin (BTC), whose market value now exceeds $1 trillion, has become more mainstream as institutional investors start to allocate part of their portfolio for the benchmark cryptocurrency, but little is known about some of the altcoins that have been surging in price.

While Bitcoin is considered a digital gold that can serve as a hedge against inflation, and Ethereum (ETH) powers the blockchain network that non-fungible tokens (NFTs) and other applications are built on, some altcoins do not have a use case at all.

finbold.com

finbold.com