Zookeeper and Wanchain are partnering together to help Zookeeper reach its goal of multi-chain adoption.

How?

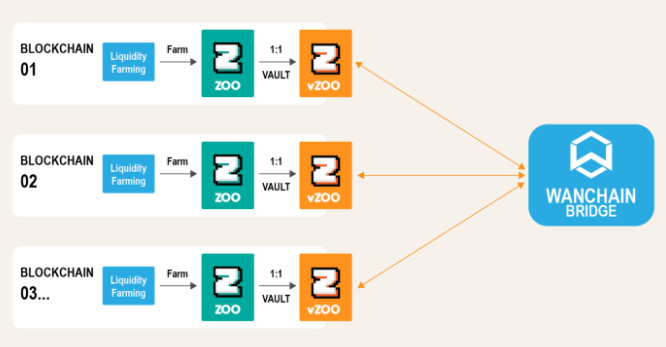

By using Wanchain’s cross-chain bridge capabilities to create a wrapped token for Zookeeper. That token will use Wanchain’s WRC-20 token standard. vZOO is the wrapped $ZOO token that will be available to go across chains.

Properties of the wrapped vZOO token include:

- vZOO’s sole purpose will be for use as collateral on other blockchains.

- They will use a Vault system on each chain to do the swap from $ZOO to vZOO

- $ZOO-vZOO will always stay at parity (1:1)

- The vault feature is a requirement to access vZOO to use across chains

Here’s how the bridge will work.

Source: Wanchain Foundation

$ZOO is both a utility and collateral token. It will be available to use as collateral for loans and other DeFi uses on many chains with this bridge solution.

More About Zookeeper

Zookeeper is one of the first yield farming DeFi apps for NFTs. Instead of staking tokens or trading pairs like most DeFi apps do, with Zookeeper you can use your NFT as collateral.

Welcome to #ZooKeeper!

🔷 Built on #Wanchain

🔷 Gamified #YieldFarming, dual rewards

🔷 #NFTs to boost farming

🔷 $ZOO staking, no impermanent loss

🔷 Multichain #Gaming platform (under construction)🌐 https://t.co/XAUBTdhox5

📢 https://t.co/Oi4yQF6GVKhttps://t.co/eAUkSPOhVE— ZooKeeper Official (@ZooFarming) October 24, 2021

Following the partnership with YGGDRAZIL, Zookeeper sees more demand for $ZOO and more ways to increase adoption. This move to use the Wanchain bridge to go multi-chain is an extension of that increased demand.

So then why a wrapped token?

Special Considerations for Using NFT as Collateral

Zookeeper reported that both:

- security concerns and

- their use of a fixed non-fungible asset as collateral (the NFT)

Were reasons why despite the goal of multi-chain adoption from the beginning that the $ZOO token is not cross-chain compatible. Its supply can never increase.

And this is why they had to create vZOO, the wrapped token.

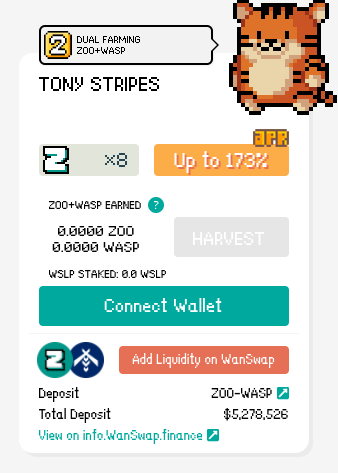

Here is an example of one of the most lucrative farming options on the site today.

Source: Zookeeper Finance

In this listing, you are able to earn up to 173% APY with a joint deposit of $ZOO and $WASP, which is Wanswap. Wanswap is another wrapped token from Wanchain. And people use this WRC-20 token for:

- Lending

- Liquidity

- or governance questions on other chains.

It’s currently the second most popular in Zookeeper’s Zoo with $5,278,526 in TVL.

About Wanchain

Wanchain’s mission is ‘decentralized finance interoperability’ as stated on their website. They believe as we do at Altcoin Buzz, that the future is multi-chain. And if we will be dealing with many chains, then we need solutions to move tokens and other assets across chains. Interoperability for Wanchain is connecting ALL chains. Wanchain has its own utility token, $WAN, that helps make bridges and swaps easier and cheaper.

Bridge volume is at an amazing $320 million so far.

True interoperable #DeFi gets closer every day. https://t.co/v9adisvvCw pic.twitter.com/vhsIvnIF79

— Wanchain (@wanchain_org) October 25, 2021

Some of the great features Wanchain bridges offer are:

- A bridge from Layer 1 to Layer 1 for decentralized app use

- A bridge from Layer 1 to Layer 2 to improve scalability

- Layer 2 to Layer 2 bridge for purposes like cross-chain payments

Bridges on Wanchain are both

- non-custodial and

- decentralized

which gives it a big edge over others that do bridges or offer wrapped tokens.

Wanchain decentralizes its bridges through its Storeman nodes. The Storeman nodes are a group of 25 nodes that work together to create the vault feature mentioned above. That locks in the $ZOO so they can maintain the 1:1 required peg and bridge it or create the wrapped token on the new chain.

The Storeman node system keeps things decentralized by:

- No wallet address private keys are available or accessible to ANY of the Storeman nodes

- Nodes only have access to a part of the private key. This is like how companies split files into many different encrypted packets for security purposes

- All Storeman nodes must stake WAN tokens. The implication here is that they can lose them for fraudulent or other bad behavior outside the scope of their role

$ZOO and $WAN Price Activity

$ZOO is trading at $0.1928 with a market cap of $12.5 million on a heavy trading volume of $1.2 million in the last 24 hours. The total circulating supply is 64.1 million and the total value locked (TVL) is $38 million.

$WAN is trading at $0.875 with a market cap of $168.9 million with a trading volume of $4.2 million in the last 24 hours. The total circulating supply is 193 million.

altcoinbuzz.io

altcoinbuzz.io